Investment Series: Return on Investment (ROI)

Howdy! We’ve been receiving an increase in requests from prospective clients, asking for advice on what makes a good investment property. Having said that, we’re excited kick off our Investment Series on the blog where we’ll look at you should consider when considering an investment property!

As a first stop, we want to look at, when purchasing a home, what will make a good Return on Investment (ROI). In order to calculate this, we want to look at the Gross Annual Revenue (return) divided by the Purchase Price (investment).

ROI = Gross Annual Revenue / Purchase Price

For Example

Gross Annual Revenue = $50,000 Purchase Price = $200,000 ROI = 25%

From here, we’ve broken out the ROI into 5 different tiers:

In order to calculate this, we want to be as objective as possible. The purchase price is easy to look at objectively, since the price is what it is, but the Gross Annual Revenue can vary quite a bit, and we want to calculate it as scientifically as possible. In order to do this, we use an analytics tool that looks at factors such as: supply/demand, occupancy rates and nightly rate directly through Airbnb. Using this data, it calculates (directionally) what your home should gross on a yearly basis. It does have a few blind-spots (niceness of home, hot tub, closeness to lake, etc.) but it helps us get closer to a true number and leaves out subjective human opinions.

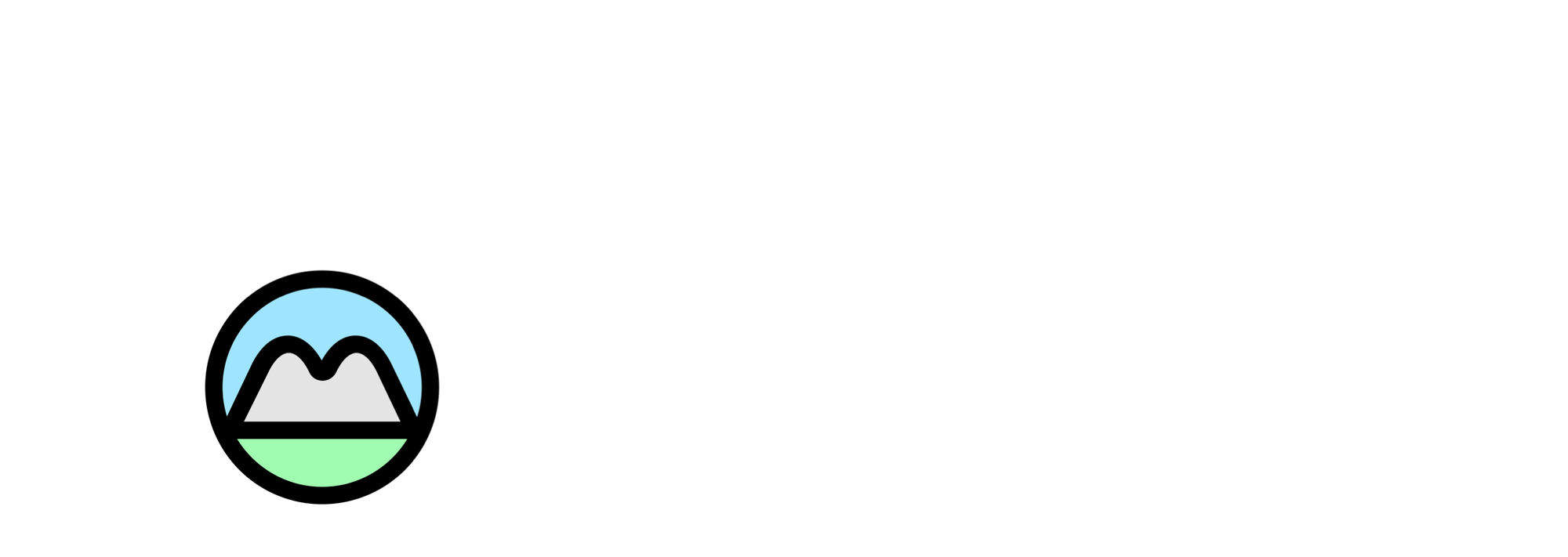

Example 1:

Return = $41,705 Investment = $219,000 ROI = 19% (good)

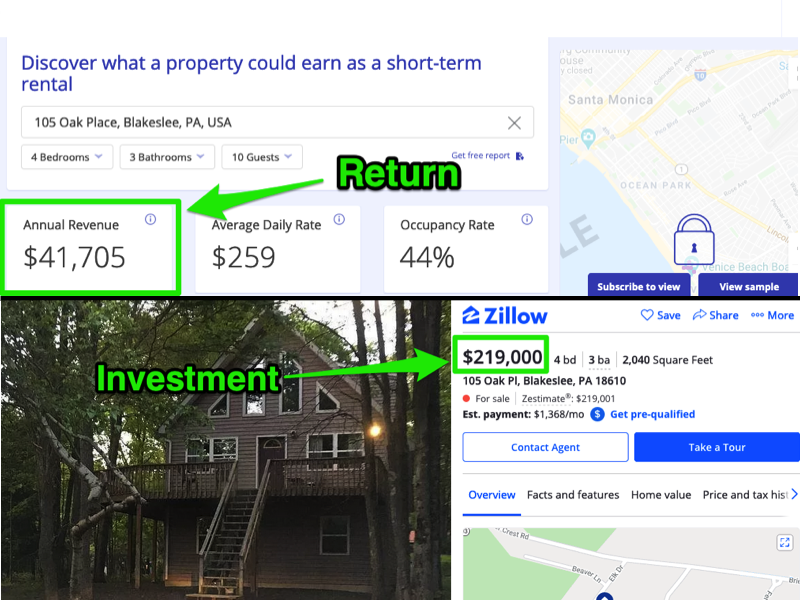

Example 2:

Return = $106,800 Investment = $325,000 ROI = 32.9% (excellent!)

We are happy to work with out prospective clients to help them seek out strong rental opportunities so they can have a profitable investment property (and/or second home)!